The Role and Future of PCBs in AI and Electronics

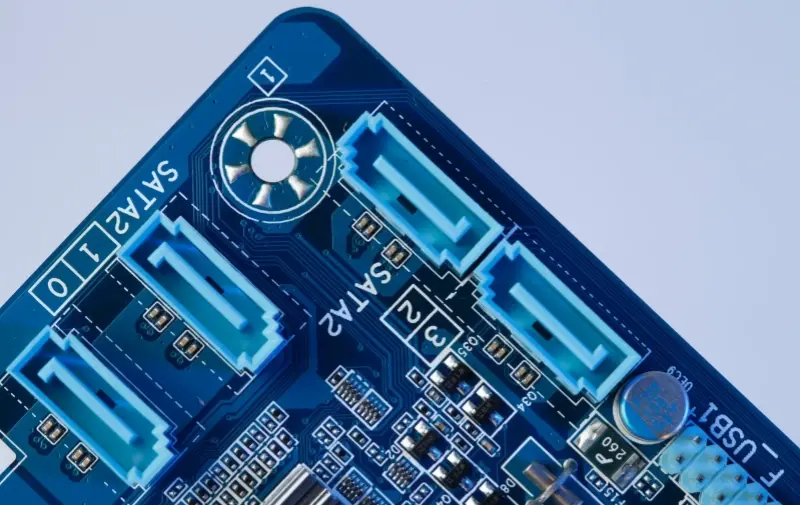

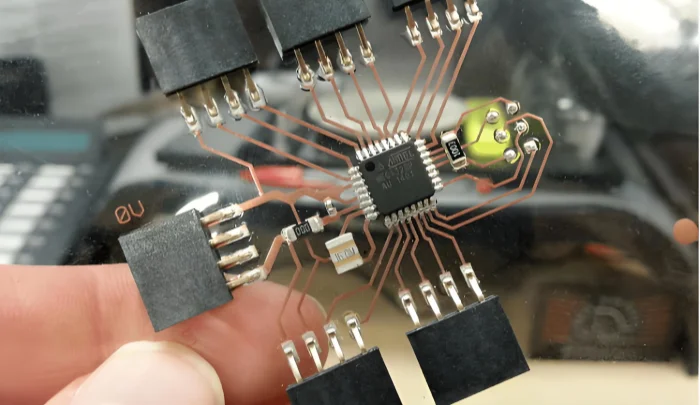

Printed Circuit Boards (PCBs) play a central role in modern electronic devices. They provide support for electronic components, connect them to form circuits, enable signal transmission, manage heat dissipation, offer packaging and protection, allow flexible design, ensure electromagnetic compatibility, and reduce electromagnetic interference. PCBs are an essential component of almost all electronic devices. Based on the number of layers, structure, and manufacturing processes, PCBs are categorized into single-sided, double-sided, multi-layer, HDI, flexible, rigid-flex, and special types (e.g., high-frequency, aluminum-based, and thick copper boards).

What does the PCB industry supply chain consist of?

The upstream of the PCB industry primarily includes raw materials such as copper foil, fiberglass cloth, and synthetic resin. The midstream consists of copper-clad laminates (CCL) and PCBs, with CCL being a critical component for PCBs. The downstream includes sectors like communication equipment, semiconductors, computers, automotive electronics, and consumer electronics.

What is the projected market growth for PCBs in the coming years?

According to Prismark data, the global PCB market value is projected to drop by 15% year-on-year to $69.5 billion in 2023. However, as inventory adjustments and weak demand in consumer electronics come to an end, and with the accelerated evolution of AI applications, the PCB market is expected to enter a new growth cycle. In 2024, the global PCB market is projected to grow by around 5%, and manufacturers’ production capacity utilization rates are expected to recover. From 2023 to 2028, the compound annual growth rate (CAGR) of the global PCB market is expected to be 5.4%, with high-layer boards, HDI, and substrate packaging boards growing faster than the industry average. Key downstream markets for PCBs include mobile phones (19%), computers (14%), automotive electronics (13%), and servers (12%). Among these, servers are expected to have the highest CAGR of 6.5%, followed by automotive electronics at 4.8%. The growth in server demand is mainly driven by platform upgrades and the rising demand for AI servers, while automotive electronics growth is fueled by developments in vehicle automation and intelligent cockpits.

Impact of AI Development on PCBs

The rise of AI-generated content (AIGC) is driving the expansion of AI servers. With the emergence of new applications such as autonomous driving, AIoT, and edge computing, major cloud service providers are increasing investments in AI-related infrastructure. TrendForce estimates that in 2023, AI servers will account for around 8% of total server shipments, and by 2024, this figure is expected to rise to 12.1%. In 2024, the four major U.S. cloud service providers (Microsoft, Google, AWS, Meta) are expected to account for over 60% of global AI server demand, with NVIDIA GPU-powered AI servers being the majority.

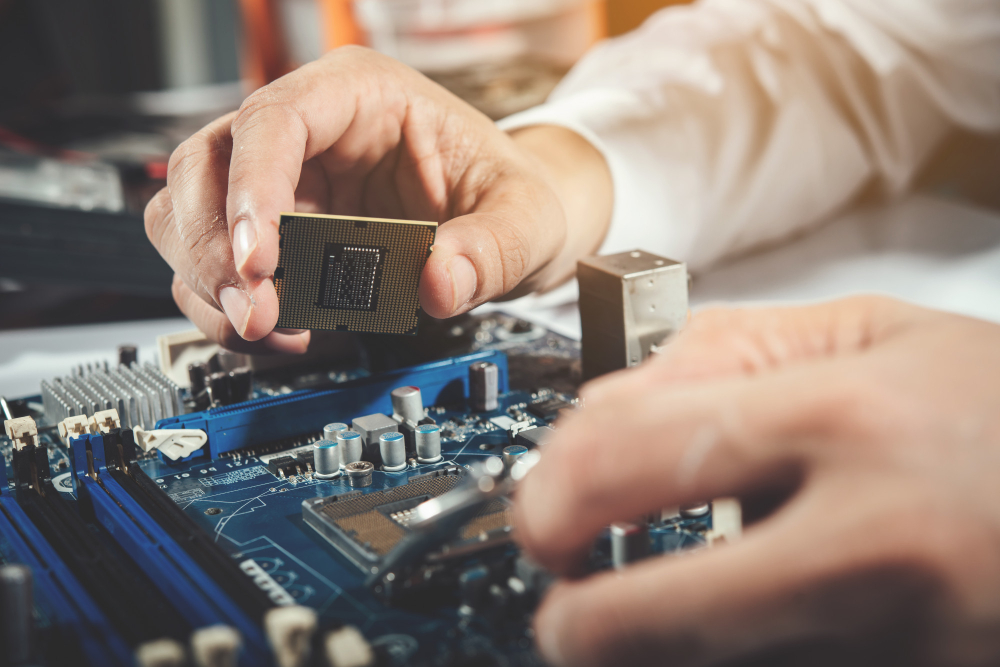

AI servers require various types of PCBs, driving new demand. These servers typically use multiple types of PCBs, including motherboard, CPU board, hard disk backplane, power backplane, memory, and network cards. The upgrade of server platforms will increase the number of PCB layers and material complexity, thus significantly increasing their value. Compared to traditional servers, AI servers create new demand for GPU boards (UBB), GPU accelerator cards (OAM), and switch boards. For example, the DGX A100 AI server contains a GPU baseboard, 8 GPU accelerator cards, and 6 NvSwitches, supporting 600GB/s high-speed interconnection between GPUs. Other components like network interfaces, hard disks, memory, power supplies, and fans also contribute to the increased PCB usage, making the overall PCB value of AI servers much higher than that of traditional servers.

Tags

Related Posts

PCBA Prototype

December 14, 2025

PCB Assembly

September 2, 2025